How Financial Offshore Solutions Can Enhance Your Wealth Protection Strategy

How Financial Offshore Solutions Can Enhance Your Wealth Protection Strategy

Blog Article

Why You Ought To Think About Financial Offshore Options for Property Defense

In a period noted by financial changes and growing litigation threats, people looking for durable asset security may find solace in overseas economic choices. These options not only offer enhanced personal privacy and possibly reduced tax obligation rates but additionally develop a critical buffer against residential economic instability.

Comprehending the Basics of Offshore Financial and Investing

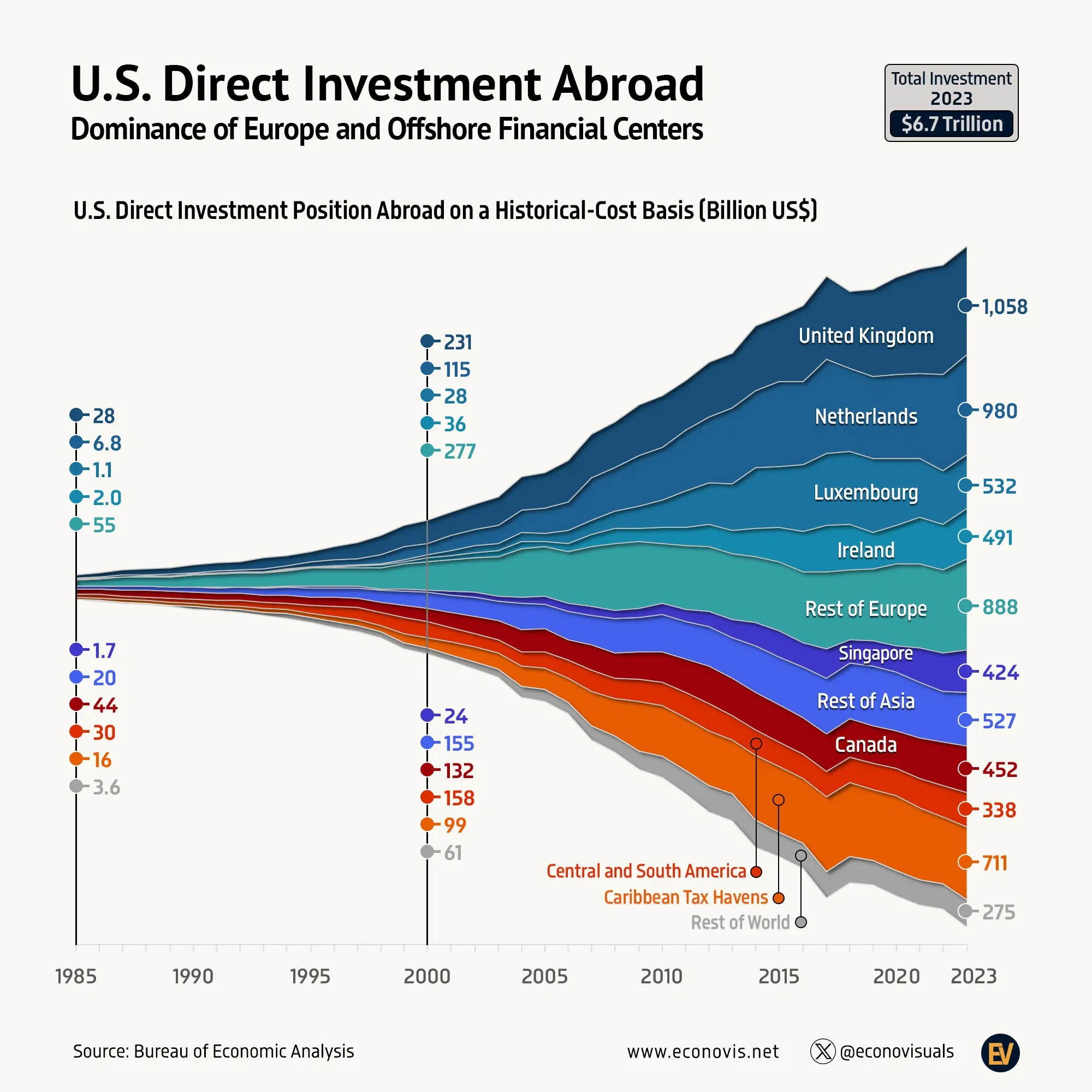

While numerous individuals look for to boost their financial protection and privacy, offshore banking and investing become feasible methods worth taking into consideration. Offshore financial refers to taking care of monetary assets in establishments located outside one's home nation, frequently in territories known for positive regulatory settings. This can include reduced tax worries and enhanced personal privacy. Offshore investing in a similar way includes positioning funding right into investment chances across different global markets, which may supply higher returns and diversification advantages.

These financial strategies are specifically appealing for those intending to secure assets from economic instability in their home nation or to access to financial investment products not available in your area. Offshore accounts might additionally supply more powerful asset defense against lawful judgments, possibly securing wealth better. Nonetheless, it's essential to comprehend that while overseas banking can use significant advantages, it additionally involves complicated factors to consider such as understanding international monetary systems and browsing exchange price variations.

Legal Considerations and Conformity in Offshore Financial Activities

Key conformity problems include sticking to the Foreign Account Tax Conformity Act (FATCA) in the United States, which calls for reporting of international monetary properties, and the Typical Reporting Requirement (CRS) set by the OECD, which includes information sharing in between countries to deal with tax evasion. Furthermore, people have to know anti-money laundering (AML) regulations and know-your-customer (KYC) guidelines, which are stringent in lots of jurisdictions to stop illegal activities.

Recognizing these legal ins and outs is essential for keeping the legitimacy and protection of offshore monetary involvements. Proper lawful guidance is necessary to ensure full conformity and to optimize the benefits of overseas economic strategies.

Comparing Residential and Offshore Financial Opportunities

Understanding the legal intricacies of overseas financial activities assists capitalists recognize the distinctions between domestic and overseas economic opportunities. Domestically, financiers are usually more familiar with the governing environment, which can provide a sense of safety and convenience of accessibility. For example, U.S. financial institutions and investment company operate under well-established legal frameworks, offering clear guidelines on taxation and financier you could try these out security.

Offshore financial chances, nevertheless, normally use higher personal privacy and potentially lower tax rates, which can be advantageous for asset defense and development. Territories like the Cayman Islands or Luxembourg are prominent due to their favorable fiscal plans and discernment. These advantages come with obstacles, including increased analysis from global regulative bodies and the intricacy of taking care of investments across various legal systems.

Capitalists need to weigh these factors meticulously. The option in between overseas and domestic alternatives ought to align with their economic goals, threat tolerance, and the lawful landscape of the particular territories.

Steps to Start Your Offshore Financial Journey

Starting an overseas financial journey calls for cautious preparation and adherence to legal standards. Individuals need to first carry out comprehensive study to determine ideal countries that use robust monetary solutions and beneficial lawful structures for property protection. This entails assessing the political stability, financial environment, and the particular laws connected to offshore economic activities browse this site in prospective countries.

The next action is to seek advice from with a monetary consultant or lawful specialist who focuses on global money and taxation. These experts can give tailored recommendations, ensuring compliance with both home country and worldwide regulations, which is essential for preventing lawful effects.

Once a suitable jurisdiction is selected, people ought to proceed with establishing up the needed monetary structures. This generally consists of opening up financial institution accounts and creating lawful entities like trust funds or firms, depending why not look here on the person's details economic objectives and requirements. Each action should be meticulously recorded to preserve openness and help with ongoing conformity with governing requirements.

Final Thought

In an age noted by economic changes and growing litigation threats, individuals looking for durable property security may find solace in overseas economic alternatives. financial offshore.Involving in offshore financial activities demands a comprehensive understanding of legal structures and governing conformity across different territories.Recognizing the lawful complexities of overseas monetary activities helps capitalists identify the differences between domestic and overseas economic possibilities.Offshore monetary opportunities, nonetheless, typically supply higher privacy and possibly lower tax prices, which can be beneficial for asset defense and growth.Getting started on an overseas monetary journey calls for cautious preparation and adherence to lawful standards

Report this page